In addition to a 9.1 percent drop on Friday, August 19th, the market cap for all cryptocurrencies dipped below the psychologically significant $1 trillion threshold. Investors are certain that the $780 billion total market cap on June 18 is a relic of the past, considering the market's most recent dive below that level occurred just three weeks ago.

On August 17, the House Energy and Commerce Committee of the United States expressed “serious worry” that proof-of-work mining could raise demand for fossil fuels, adding to the regulatory ambiguity that had already existed. Therefore, US senators are requesting data from bitcoin mining firms regarding energy usage and typical expenses.

Cryptocurrencies outside the top 5 by market size usually lose more ground during a sell-off, but today's correction only resulted in losses between 7% and 14% across the board. Bitcoin (BTC) dropped 9.7 percent to a low of $21,260, and Ether (ETH) fell 10.6 percent to a low of $1,675 during the day.

Given the asset's 67% yearly volatility, some may argue that a strong daily correction like the one experienced today is more the rule than the exception. For example, the present correction is more severe than the 9% decline in market capitalization that occurred in 19 days over the past year.

The premium on BTC futures contracts has evaporated.

Futures contracts with a fixed delivery month typically trade at a premium above the spot market, since sellers require more payment to hold goods for a longer period of time. This phenomenon, known in the jargon as “contango,” is hardly unique to digital currencies.

Futures trading at a premium of 4% to 8% per year, which is sufficient to pay for risk and the cost of capital, is indicative of a robust market.

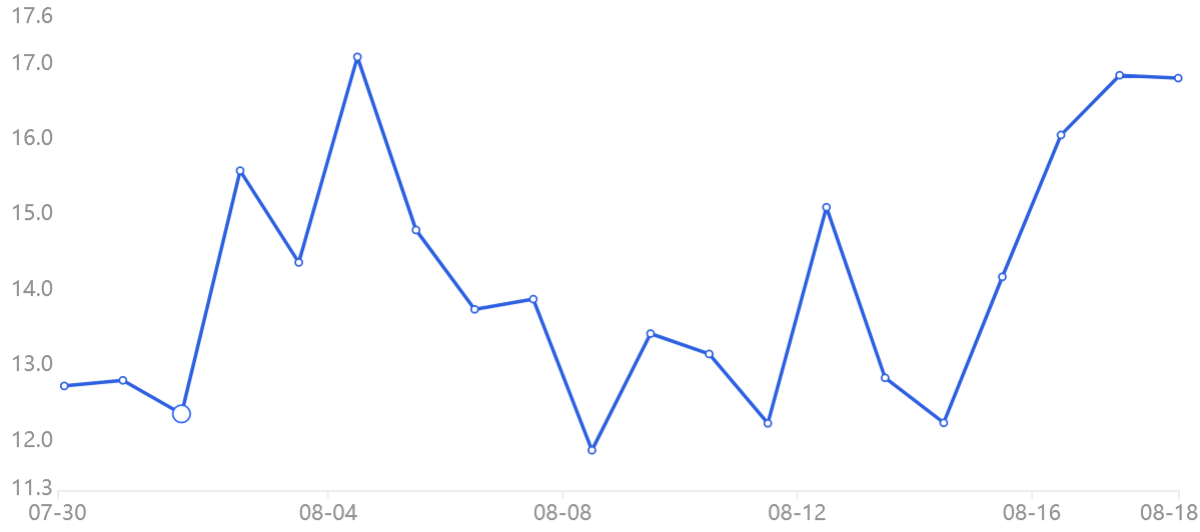

Bitcoin annual premium for a 3 month term. Laevitus, the source.

OKX and Deribit Bitcoin futures premium data suggests that the negative 9.7 percentage point BTC swing discouraged investors buying derivative products. Any time the indicator begins trading in the negative, or “backward,” it usually indicates a surge in demand from speculators who are using leveraged short positions in the hopes of driving prices more lower.

Over $470 million has been liquidated from leveraged buyers.

Futures contracts are simple, low-cost financial products that provide leverage. The danger of employing it resides in liquidation, meaning that the margin deposit of investors becomes insufficient to cover their positions. In this situation, the cryptocurrency collateral is automatically bought and sold by the exchange's deleveraging mechanism.

Leverage allows a trader to raise their profits by a factor of 10, but the position is closed if the value of the underlying asset falls by more than 9 percentage points from where it was opened. The sale of collateral by derivatives exchanges will continue, which will result in the formation of a vicious cycle known as tiered liquidation. As can be seen in the image on the right, the selling pressure on August 19 resulted in the biggest number of buyers being forced to sell since June 12.

Investors that trade on margin are overly optimistic and have been crushed.

Investors have the ability to borrow cryptocurrency through margin trading, which enables them to grow their trading positions and perhaps enhance their returns. For instance, a trader could increase their crypto exposure by buying Bitcoin using Tether (USDT) that they borrowed from another person. Borrowing Bitcoin, on the other hand, may only be utilised for shorting the cryptocurrency.

In contrast to futures contracts, the long margins and short margins do not always have to be in balance with one another. When the ratio of margin loans to total loans is high, it suggests that the market is bullish; on the other hand, when the ratio is low, it shows that the market is bearish.

It is common knowledge that cryptocurrency traders are positive, which is logical given the potential for widespread adoption and rapidly expanding use cases such as decentralised finance (DeFi) and the idea that certain cryptocurrencies offer insurance against USD inflation. The 17 times greater margin lending rate is evidence of overconfidence among leveraged buyers and promotes anomalous stablecoins.

These three derivatives market metrics demonstrate that traders do not anticipate the entire cryptocurrency market to correct as dramatically as it did today, nor do they anticipate the total market cap to retest the support level of one trillion dollars. This fresh lack of trust might result in more gains for borrowers, which would reduce their leveraged situations and would set off new lows in the weeks to come.

The thoughts and opinions presented here are solely those of the author and do not reflect those of Cointelegraph in any way. Investing and trading in general are fraught with danger at every stage. Before selecting a choice, it is important that you conduct your own study.